Brazil’s 2025 Debt Spree and the Magnitsky Act’s Shadow: A Conservative Warning By Hotspotnews

For the third time in 2025, Brazil has tapped global debt markets, a frequency unseen in over a decade. The Treasury issued a 30-year bond yielding 7.5% and reopened a five-year note at 5.2%, raising $1.75 billion.  Led by JPMorgan and Bank of America, this move is hailed by the government as a sign of investor confidence. Yet, from a conservative perspective, it exposes a reckless reliance on foreign borrowing to mask fiscal mismanagement, compounded by risks from the Magnitsky Act that threaten financial stability.

Led by JPMorgan and Bank of America, this move is hailed by the government as a sign of investor confidence. Yet, from a conservative perspective, it exposes a reckless reliance on foreign borrowing to mask fiscal mismanagement, compounded by risks from the Magnitsky Act that threaten financial stability.

Brazil’s fiscal situation is dire. Public debt hit 76.1% of GDP in 2024 and is projected to reach 79.6% by 2028. Nearly half of this debt is tied to floating-rate bonds linked to the Selic rate, currently at 15% and likely to rise. Each rate hike inflates debt servicing costs, draining funds from critical areas like infrastructure and education. The Treasury’s goal of reducing these bonds’ share to 23% by 2035 seems unrealistic given unchecked spending. Instead of cutting bloated social programs, public sector pay raises, or inefficient bureaucracies, the Lula administration leans on external loans, signaling fiscal weakness.

The Magnitsky Act, a U.S. law targeting human rights violators and corrupt officials, adds a new layer of risk. In July 2025, STF Minister Alexandre de Moraes was sanctioned under this act following accusations from Congressman Eduardo Bolsonaro to the U.S. Treasury. In September, the U.S. Treasury Department contacted five major Brazilian banks—Itaú Unibanco, Santander, Bradesco, Banco do Brasil, and BTG Pactual—demanding details on compliance with sanctions against Moraes, which include asset freezes in the U.S. and bans on transactions with American financial systems, such as credit card networks. While JPMorgan and Bank of America were not explicitly named, their role in managing Brazil’s bond issuances puts them under scrutiny, as they operate within U.S. jurisdiction.

For JPMorgan and Bank of America, the Magnitsky Act poses serious risks. Non-compliance could lead to hefty fines, restricted access to U.S. financial systems, or reputational damage. However, adhering to the sanctions in Brazil is problematic. In August 2025, STF Minister Flávio Dino ruled that foreign laws like the Magnitsky Act have no automatic effect in Brazil without local ratification, citing national sovereignty. This creates a dilemma for international banks: comply with U.S. law and risk clashing with Brazilian authorities or ignore the sanctions and face U.S. penalties. For JPMorgan and Bank of America, managing Brazil’s bond sales, this introduces operational uncertainty that could drive up borrowing costs and deter investors.

The dangers are manifold. First, Brazil’s reliance on floating-rate debt makes it vulnerable to interest rate spikes, especially as global monetary conditions tighten under U.S. policy shifts. Second, frequent bond issuances signal a lack of fiscal discipline, eroding investor confidence. Third, the Magnitsky Act tensions could heighten financial sector volatility, with JPMorgan and Bank of America caught between international compliance and local operations. Finally, the government’s focus on borrowing over structural reforms stifles productivity-driven growth, which the World Bank deems essential for Brazil to escape the middle-income trap.

Conservatives see this as a recipe for disaster. Relying on external loans, now complicated by geopolitical risks like the Magnitsky Act, is unsustainable. The government must embrace free-market reforms, slash wasteful spending, and incentivize private-sector growth to boost revenue organically. Without these steps, Brazil is hurtling toward a debt crisis, while banks like JPMorgan and Bank of America navigate a minefield of sanctions and regulatory uncertainty. The third bond sale of 2025 is a warning: without fiscal discipline and resolution of international legal conflicts, Brazil and its financial partners risk severe consequences.

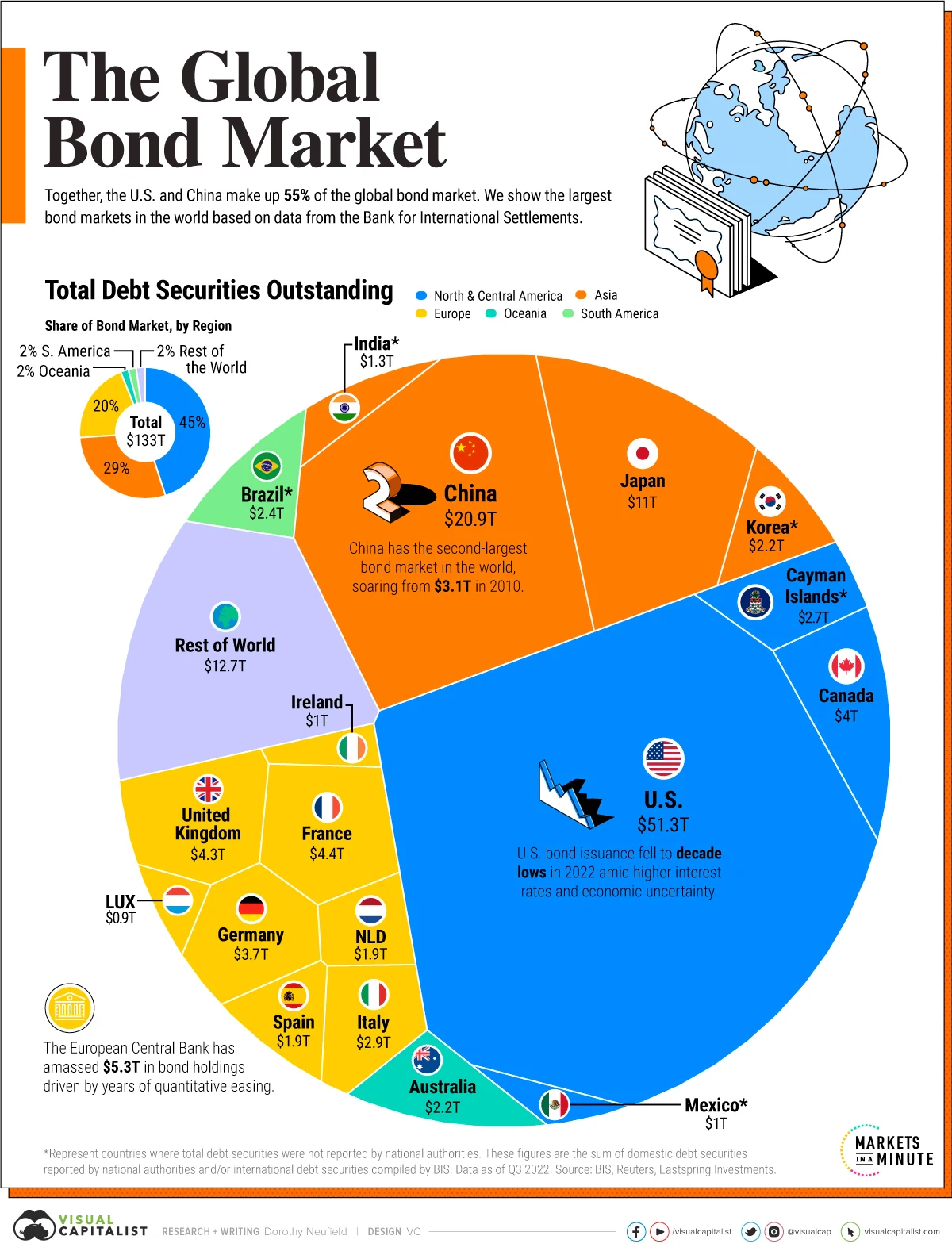

source: X, Reuters, markets minute

PORTUGUESE

A Farra de Dívidas do Brasil em 2025 e os Riscos da Lei Magnitsky: Uma Visão Conservadora

Por Hotspotnews

Pela terceira vez em 2025, o Brasil recorreu aos mercados globais de dívida, algo não visto há mais de uma década. O Tesouro emitiu um título de 30 anos com rendimento de 7,5% e reabriu um título de cinco anos a 5,2%, captando US$ 1,75 bilhão. A operação, liderada por JPMorgan e Bank of America, é apresentada pelo governo como prova de confiança dos investidores. No entanto, sob uma perspectiva conservadora, essa estratégia revela uma perigosa dependência de endividamento externo, agravada por riscos geopolíticos ligados à Lei Magnitsky, que podem comprometer a estabilidade financeira do país.

A situação fiscal brasileira é preocupante. A dívida pública atingiu 76,1% do PIB em 2024 e deve chegar a 79,6% até 2028. Quase metade dessa dívida está atrelada a títulos de taxa flutuante vinculados à Selic, atualmente em 15% e com tendência de alta. Cada aumento de juros eleva os custos de serviço da dívida, reduzindo recursos para investimentos em áreas como infraestrutura e educação. O plano do Tesouro de reduzir a proporção desses títulos para 23% até 2035 parece improvável, dado o gasto público desenfreado. Em vez de cortar programas sociais excessivos, aumentos salariais no setor público ou burocracias ineficientes, o governo Lula opta por empréstimos externos, sinalizando fraqueza fiscal.

A Lei Magnitsky, legislação americana que impõe sanções a indivíduos acusados de violações de direitos humanos ou corrupção, adiciona uma camada de complexidade. Em julho de 2025, o ministro do STF Alexandre de Moraes foi sancionado sob essa lei, após denúncias do deputado Eduardo Bolsonaro ao Tesouro dos EUA. Em setembro, o Departamento do Tesouro americano questionou cinco grandes bancos brasileiros — Itaú Unibanco, Santander, Bradesco, Banco do Brasil e BTG Pactual — sobre o cumprimento das sanções, que incluem congelamento de ativos nos EUA e proibição de transações com sistemas financeiros americanos, como redes de cartões de crédito. Embora JPMorgan e Bank of America não tenham sido diretamente citados, sua liderança nas emissões de títulos brasileiros os coloca em uma posição delicada, já que operam sob jurisdição americana.

Para JPMorgan e Bank of America, a Lei Magnitsky representa um risco significativo. O descumprimento das sanções pode resultar em multas, restrições no acesso ao sistema financeiro americano ou danos à reputação. No entanto, cumprir as sanções no Brasil é desafiador, pois o STF, por decisão do ministro Flávio Dino em agosto de 2025, determinou que leis estrangeiras, como a Magnitsky, não têm validade automática no Brasil sem ratificação local, sob o argumento de soberania nacional. Essa decisão coloca bancos internacionais em um dilema: seguir a lei americana e enfrentar conflitos com autoridades brasileiras ou ignorar as sanções e arriscar penalidades nos EUA. Para JPMorgan e Bank of America, que gerenciam as emissões de títulos, isso cria incertezas operacionais que podem elevar os custos de captação do Brasil e afastar investidores.

Os riscos são numerosos. Primeiro, a dependência de títulos de taxa flutuante expõe o Brasil a choques de juros, especialmente em um cenário de aperto monetário global influenciado pelos EUA. Segundo, emissões frequentes de títulos sinalizam falta de disciplina fiscal, minando a confiança dos investidores. Terceiro, as tensões envolvendo a Lei Magnitsky podem aumentar a volatilidade no setor financeiro, com JPMorgan e Bank of America enfrentando pressões para equilibrar compliance internacional e operações locais. Por fim, a insistência do governo em financiar déficits com dívida, em vez de promover reformas estruturais, impede o crescimento baseado em produtividade, essencial para o Brasil superar a armadilha de renda média, conforme alertado pelo Banco Mundial.

Conservadores enxergam essa situação como uma receita para o desastre. A dependência de empréstimos externos, agora complicada por riscos geopolíticos como a Lei Magnitsky, é insustentável. O governo deve priorizar reformas de mercado livre, cortar gastos desnecessários e incentivar o setor privado para aumentar a arrecadação de forma sustentável. Sem essas medidas, o Brasil caminha para uma crise de dívida, enquanto bancos como JPMorgan e Bank of America enfrentam um cenário de incertezas regulatórias e sanções. A terceira venda de títulos de 2025 é um alerta: sem disciplina fiscal e resolução dos conflitos legais internacionais, o Brasil e seus parceiros financeiros correm o risco de enfrentar consequências graves.