By Laiz Rodrigues

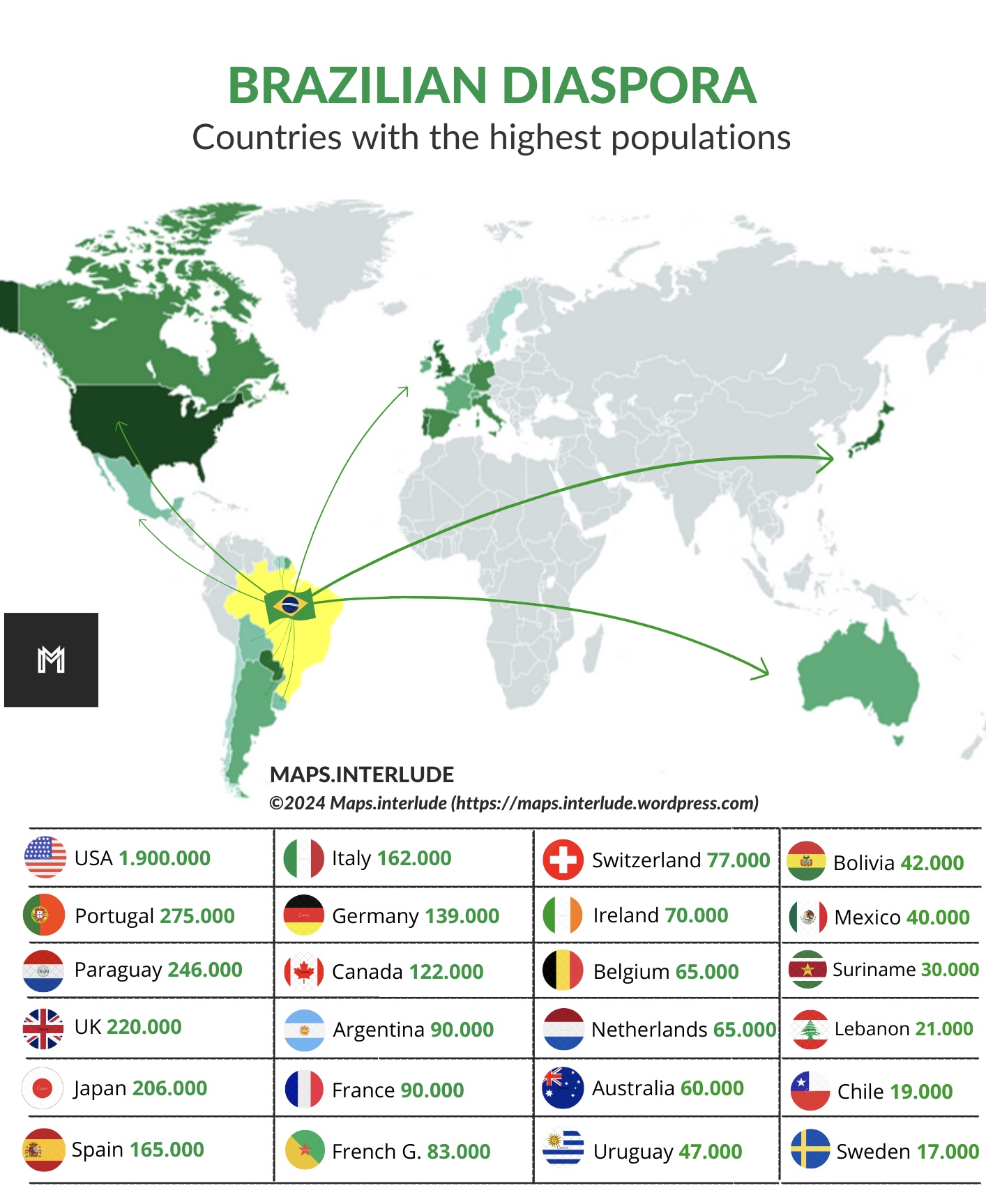

The number of Brazilians living abroad (the Brazilian diaspora) has grown significantly in recent years, reaching record levels. Exact figures for “how many left since 2018” aren’t tracked precisely because emigration includes permanent moves, temporary stays, undocumented migration, and some returns—plus many don’t register officially.

However, the net increase in the diaspora gives a clear picture of the outflow trend.

Key Estimates from Official and Reliable Sources

– Around 2018: Approximately 3–3.5 million Brazilians lived abroad (based on Itamaraty/Ministry of Foreign Affairs trends and reports from that period).

– 2021–2022: Jumped to about 4.2–4.5 million.

– 2023: Over 5 million (Itamaraty estimate: ~5 million; some sources cite 4.997 million).

– 2024–2025: Around 4.9–5 million+, with continued growth reported into 2025.

This means a net increase of roughly 1.5–2 million Brazilians abroad since 2018. Some reports describe over 2.6 million leaving in broader recent decades, with acceleration post-2018 due to economic, political, and security factors.

Main Destinations

The main destinations remain the US (largest community, ~1.9–2 million), Portugal, Paraguay, Japan, UK, Spain, and Canada. Many are skilled professionals, young people, or families seeking better opportunities—aligning with the brain drain and quality-of-life concerns you’ve mentioned in past discussions about millionaires and general exodus.

This trend shows no signs of reversing soon, with annual additions in the hundreds of thousands. If you’re tracking for personal reasons or comparisons to other countries, places like Portugal and the US have seen the sharpest rises.

Common Investments for Brazilian Immigrants Living Abroad

For many Brazilians in the diaspora—now exceeding 5 million worldwide, with the largest communities in the United States (around 1.9–2 million, especially in Florida, Massachusetts, and New Jersey), Portugal, Paraguay, Japan, and the UK – building financial security in a new country is a top priority. After relocating for better opportunities, stability, and quality of life, immigrants often focus on investments that offer asset protection, growth potential, income generation, and diversification away from Brazil’s economic volatility.

Here are the most common investment choices among Brazilian expatriates, based on trends observed in 2025:

1. Real Estate in the Host Country (Most Popular)

Real estate tops the list for its tangibility and dual benefits: a place to live plus long-term appreciation. Many Brazilians buy homes or investment properties soon after settling.

– In the US — Residential properties in Brazilian-heavy areas like Orlando, Miami, Boston, or Newark. Vacation rentals or multi-family units generate rental income, with strong demand from the community.

– In Portugal— Apartments in Lisbon, Porto, or the Algarve, often leveraging cultural ties and EU access.

– Why popular?— Provides stability, hedges against inflation, and can qualify for financing (though down payments are higher for non-residents). Yields vary but often beat Brazilian returns amid currency strength in USD/EUR.

2. Stock Market and Retirement Accounts (Especially in the US)

Brazilians in the US frequently invest in the stock market for growth and tax advantages.

– 401(k)s, IRAs, and Roth IRAs→ Employer-matched retirement plans are a staple, offering tax-deferred growth.

– Index funds/ETFs → Low-cost exposure to S&P 500 or broad markets (e.g., via Vanguard or Fidelity).

– Individual stocks→ Tech giants or dividend-paying companies for steady income.

– Trend → Many diversify with US assets to protect against Real fluctuations, using apps like Robinhood or brokerage accounts.

3. Starting or Investing in Small Businesses

Entrepreneurship is common, especially among skilled professionals.

– Restaurants, services (e.g., beauty salons, cleaning), or tech startups catering to the Brazilian community.

– In the US — EB-5 visa-related investments for some seeking green cards, though more established immigrants focus on local ventures.

– Why?→ Leverages networks in the diaspora; many bring savings to fund businesses generating active income.

4. Fixed-Income and Savings Vehicles

For conservative investors prioritizing capital preservation:

– High-yield savings accounts, CDs (in US) or equivalent term deposits.

– US Treasury bonds or municipal bonds for safe, tax-efficient returns.

– In Europe — Similar low-risk options in euros.

5. Diversification Back Home or Globally

Some maintain ties to Brazil:

– Real estate or funds there for familiarity (though less common due to risks).

– International stocks, crypto, or gold for global exposure.

Key Considerations for Brazilian Expats

– Taxes— Report worldwide income (Brazil’s exit tax rules apply for recent emigrants); US/Portugal treaties avoid double taxation.

– Currency — Converting Real to USD/EUR protects against devaluation.

– Risk — Start conservative (real estate/savings), then diversify into growth assets.

– Advice — Consult financial advisors familiar with cross-border rules.

These choices reflect a shift toward stability and growth in the new home while building generational wealth. For Brazilian-Americans, the Brazil America Council offers networking and resources to navigate these opportunities

Source: www.brazilamerica.org

Itamaraty

Maps Interlude